Sending invoices by post is already a thing of the past in many companies. At the same time, customer requirements regarding the type of invoicing are increasing.

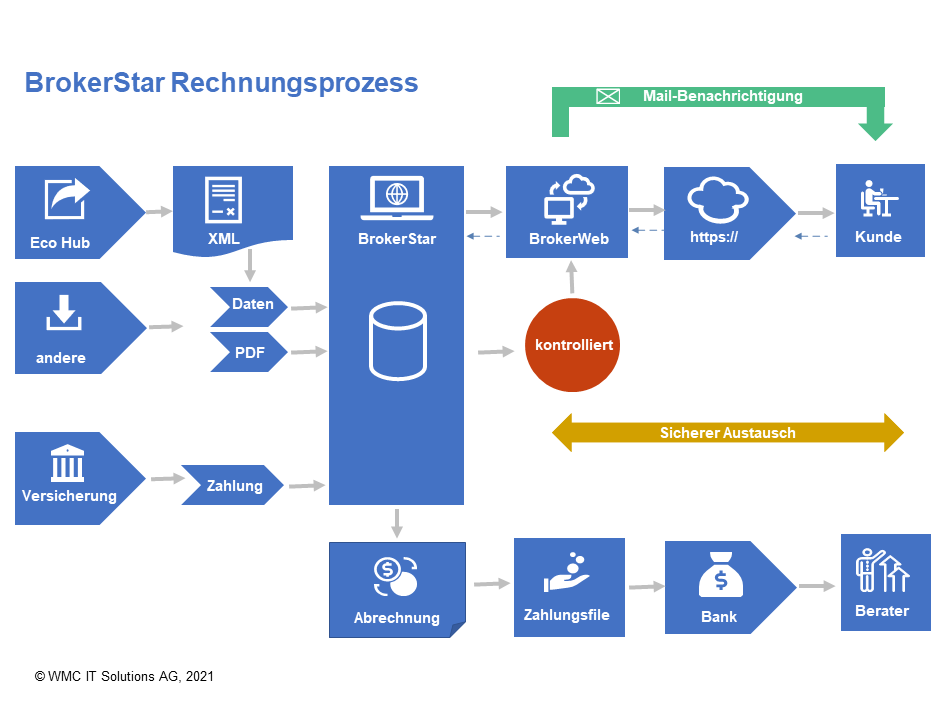

BrokerStar offers four options for sending invoices automatically:

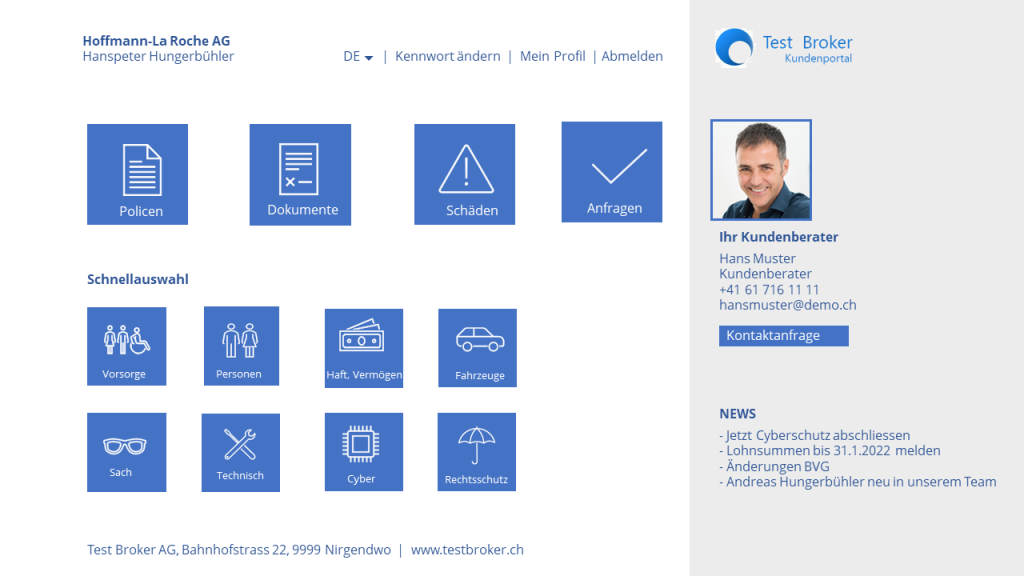

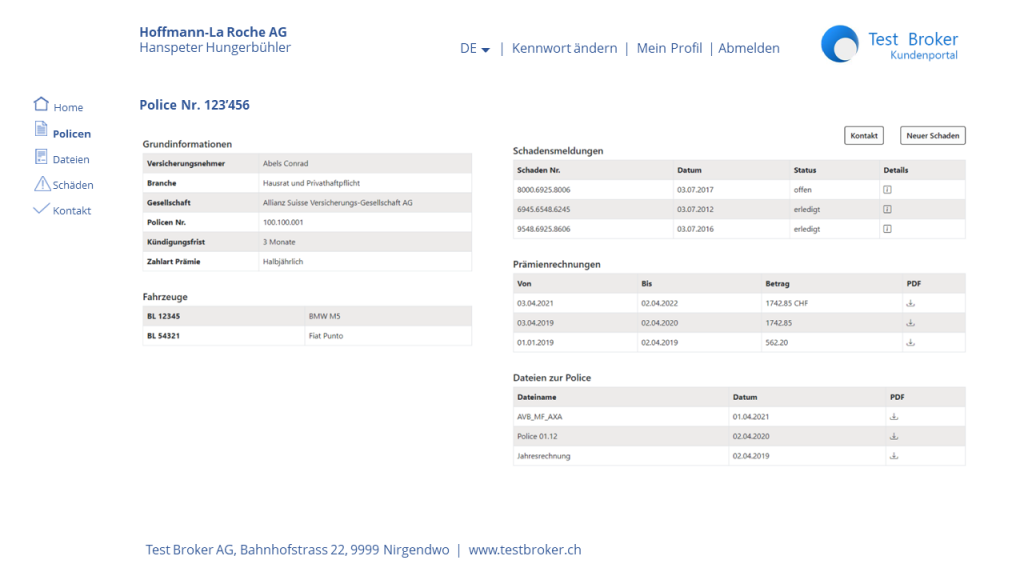

- Available in the BrokerWeb customer portal

- Dispatch by e‑mail

- Secure electronic dispatch with BriefButler

- Electronic transmission to the BriefButler mail centre. This takes over the Printout and dispatch by post

Automatic dispatch offers you the following advantages:

You save money as there are no postage, paper, toner or envelope costs.

You save time thanks to the fast & uncomplicated dispatch of invoices

You protect the environment as there is no need for physical paper despatch

You can also send additional PDFs as attachments

Your customers can read invoices directly in the system (PDF) thanks to the QR code

You have complete control, which vouchers have been sent, which are outstanding?

Dirk Bingler has been involved in the Bitkom association since 2014. His topics are the future of ERP systems and their impact on digitalisation. He has over 20 years of experience in the internat. environment at Siemens AG.

Dirk Bingler has been involved in the Bitkom association since 2014. His topics are the future of ERP systems and their impact on digitalisation. He has over 20 years of experience in the internat. environment at Siemens AG.